@interfluidity this is utter nonsense. the concept of ordinal utility has been obliterated. it is a complete crank fringe concept, trivially refuted by a revealed preference lottery.

https://www.rangevoting.org/Mill

You lack the understanding of economics that most people have after reading Wikipedia for 30 minutes. or even just... observing any human in the real world under uncertainty.

@cshentrup why do you think it helps a conversation to insult people?

i wish you were right, that economics as a discipline were more open to cardinal utilities. i think it was broadly an error to insist upon ordinality (an error made bc the profession wished to be scientistic in the way that you also wish to be, to be able to offer authoritative statements independent of values). but take a course in microeconomics and you will learn the contemporary consensus remains utility must be ordinal.

I have refuted you through and through. No one in the field of economics seriously proposes ordinal utilities. You are living in a fantasyland. come to Jesus man.

@interfluidity You are out of your mind. I have been in this field for almost 20 years and interacted with numerous economists. No one in the modern era seriously believes in ordinal utilities. You are dreaming.

@interfluidity or if they do, they will readily concede the point if you just show them the results of a revealed preference lottery. I've literally done this.

I'm taking a microeconomics course right now from the University of Illinois, just for fun, and not seeing anybody propose ordinal utilities.

@cshentrup from Mas-Colell, the preeminent textbook in microeconomic theory (very expensive, but hey there's a pdf just sitting there) http://www.hawkinqian.com/uploads/media/2014/09/Microeconomic_Theory.pdf

@cshentrup "the preference relation associated with a utility function is an ordinal property"

here's another screenshot, same PDF (this PDF appears to be a draft of an edition, since we see Exercise ??), "the special forms of the utility representations in (i) and (ii) are not preserved; they are —it cardinal properties that are simply convenient choices for a utility representation."

@cshentrup when I was taught this stuff, I was taught that utility functions are equivalent across affine transformations, ie given a utility function U(c), any function of the form a(U(c)) + b represents precisely the same preferences.

@interfluidity Yes. your point?

@cshentrup it means you can't talk about utils as a quantity. if we let U=log(c) and c=100, we might as well have said U=100 log(c). you might argue that this is just a change in units, ie Fahrenheit is just an affine transformation of degrees Kelvin. but the substantive point is that you can't compare interpersonally. there is no way i can define U so that 10 utils of Jane's utility is worth the same as 10 utils of Joe's. there's no way to calibrate across people.

@interfluidity You are a predictable caricature of utilitarian misunderstandings. utilities don't need to be interpersonally comparable.

https://clayshentrup.medium.com/understanding-social-utility-through-harsanyis-argument-528ba25241fd

@cshentrup your piece describes a normative point — one that i agree with ( and have written about https://www.interfluidity.com/v2/5486.html )

as a matter of policy, it does not matter, to me, that perhaps you are a "utility monster" and giving you a chocolate perhaps from some neurological or whatever perspective gives more pleasure than my basic bread gives me. 1/

@cshentrup in something like the harsanyi thought experiment, i'll simply argue that as a normative matter, when we model policy, we should treat one another as having the same preference (over broad aggregates like money or access to health care, not over chocolate vs vanilla).

but that is an axiom. there's is no empirical data or fact about the world that justifies the choice. it is not "empirical". it simply reflects my (and i suspect your) egalitarian values. /fin

@interfluidity of course there is objective empirical data here. for instance, someone like my wife who has Marfan syndrome and needed a 1 million heart operation has a different decreasing marginal utility per dollar than someone without that condition. this part of the reason we can justify a universal health care system versus just giving people money.

You come across like someone who has very little experience in welfare economics.

@interfluidity I mean it's fine if you just took a run of the mill economics degree and have a lot of these common blind spots. But you talk as if you have some stronger expertise in this field and yet you make pretty blatant novice fallacies that we experts in the field see often. like you thought we needed to have interpersonal utility comparisons. I wrote that blog post because of how common this misunderstanding is among lay people like yourself.

@cshentrup again, i will say that i think some of your views could be much better thought-out and developed (and i think the scientism you pretend to, that there are true correct answers to social questions independent of values is quite destructive in practice), but i don't see the purpose of insulting people, even if i disagree with them, think little of their views, think their views counterproductive in social and political affairs.

@interfluidity they are already very well thought out and developed. You are just being tripped up by common novice fallacies. like you just demonstrated a confusion where you thought we would need interpersonal utility comparisons to compare a house to a surgery. I can explain for you why that's wrong if you like but it's obviously wrong and you are confused.

@interfluidity we are simply asking which policy any given individual would support for their own selfish reasons. No interpersonal comparison of utility is required. by merely talking about interpersonal comparisons of utility, you demonstrate that you are deeply confused.

@cshentrup you are asking people to conduct a thought experiment in which they don't know anyone's identities. when they do know identities, they value their own houses over other people's surgeries all the time. i like your (harsanyi’s, rawls') hypothetical! i think it encourages people to be better, to not privilege people by their identities. but none of us lives up to it, and the market system you admire signally weights welfare by purchasing power. it is not incontestable.

@interfluidity No no no no no

You're taking that term too literally. You might know that you are a billionaire and therefore support low tax rates. but there are things you don't know about your future self. All that is practically irrelevant is uncertainty about the future. again you're not following.

@cshentrup billionaires do not actually behave, particularly in their policy advocacy, as though they might become paupers next year. and you and i won't give up our homes because someone needs surgery they have no insurance for, even though our own values (or your utility computations) would suggest perhaps we should.

@interfluidity of course billionaires are very unlikely to become paupers next year. whatever you're arguing against it's not any argument that I have made. as I just explained your wildly exaggerating the point about uncertainty. All we're saying is that there is some uncertainty.

@interfluidity what is true is that a billionaire would treat a chance to earn a million dollars as almost equivalent to 50% chance at making 2 million.

@cshentrup I agree. The preferences of the very wealthy become close to risk neutral, over ranges where the losses leave their wealth at very far from levels that would threaten their actual consumption amenities.

@interfluidity You've got to stop using the word risk. risk is like epicycles. the issue is diminishing marginal utility.

for instance if you take the guarantee of a million dollars over a 50% chance at 3 million, there is a 50% risk you lost half a million. so "risk" is a stupid nonsense word. there's just expected utility.

@cshentrup economists use expectation over Von Neumann–Morgenstern utility functions ("expected utility") to characterize risk preferences. lots of people would take a guarantee of 1M over a 50% chance of 3M, suggesting they are risk averse. the fact people are willing to forego in expectation 0.5M is an interesting observation about actual human preferences. it's hard to express that without saying that, over this range, the person who chooses 1M prefers certainty or lack of risk.

@interfluidity it's not risk preference it's utility maximization preference. calling it risk is obviously stupid as I demonstrated.

> suggesting they are risk averse

I just proved this is nonsense. there is a 50% risk you lost half a million. You obviously can't use the term risk here. You are an idiot.

@cshentrup I find this discussion not so informative. But you are not an idiot, and I won't call you one.

@interfluidity Well you're not an idiot compared to the average human walking around. maybe you are in the 99th percentile but you aren't in the 99.9th.

and of course it was informative because I demonstrably taught you a bunch of things you didn't know, most notably how interpersonal utility comparisons aren't necessary to justify utilitarianism in any sense.

@cshentrup i'm glad to be informed, and the harsanyian / rawlsian /shentrupian thought experiment is a fine one, but it has been my view for a long time that that social-welfare-function-style "utilitarianism" is a worthy exercise despite incomparable interpersonal utility. our difference is that i recognize the result of such exercise as inherently reflecting the values of the exercisor, and you think it can reflect scientific truth only a fool could deny, regardless of values.

@interfluidity You have cited zero evidence that there are any values involved. You have to stop making claims without evidence to back them up. it's deeply childish and obnoxious.

@cshentrup have a wonderful evening! some time has passed.

@interfluidity sure. You too. And as always, get back to me if you ever find us until of evidence to support your assertion that anything I claimed involves subjective unproven values. I'll wait.

@interfluidity avoid a rawlsian " veil of ignorance" interpretation. we aren't talking here about being ignorant of your identity. we're purely focusing on the part about being self-interested.

for instance imagine Alice Bob and Eve are being asked which of several economic regimes they want. to simplify let's just imagine they are voting on how to allocate a sum of cash. Alice is in poverty, Bob is middle class and Eve is a billionaire hedge fund manager or whatever...

@interfluidity of course the ideal policy for each of them is that they are the one who receives 100% of that lump sum of cash. but the other two wouldn't go along with that. they would overpower that single winner. so what we are looking for here is the Nash equilibrium in a self-interested game theory sense.

@interfluidity a great example. a revenue neutral land value tax distributed as a UBI would make 70% of citizens better off. thus a huge majority has an incentive to promote such policy, if they are properly informed.

https://www.ubicenter.org/uk-lvt

this requires no ignorance about your identity.

@cshentrup i think you'll find people who identify as owners of valuable land will be unenthusiastic about the policy, and they'll have some success convincing lots of others! (i'd be for it!)

@interfluidity it doesn't matter if you have valuable land if the corresponding refundable tax credit makes you net ahead. which it would for 70% of the population.

I'm just saying, regardless of the political challenges, that it would be in the rational self-interest of a vast majority. this is the only thing I'm getting at with utilitarian policy. we're just talking about the Nash equilibrium that you would get to if everybody was properly informed.

@cshentrup there are lots of policies that would benefit more than 70% of the population that 70% of the population don't meaningfully support. a UBI financed by an income tax increment, which i think you don't favor, could be set so that more than 70% come out net ahead. that's not on its own dispositive, politically or as a matter of policy.

@cshentrup the thing about Nash Equilibria is that in the most common case, they are not unique. almost anything can be a Nash Equilibrium, under the right circumstances. https://en.wikipedia.org/wiki/Folk_theorem_(game_theory)

@interfluidity That isn't the case with economics because you can compensate people. kaldor-hicks efficiency. I need to write a blog post about this because I research it then forget the details a few times a year.

@cshentrup kaldor-hicks efficiency is incoherent. it doesn't define an ordering. https://www.interfluidity.com/v2/5212.html

@interfluidity it's perfectly coherent, because you can address distributional effects orthogonally.

@interfluidity My point was that there are no condorcet cycles if you can create candidates via redistribution scenarios.

@interfluidity try to create even a simple hypothetical example where Bob Alice and Eve Don't have a unique Nash equilibrium given that we can create infinite scenarios via redistribution.

@cshentrup if you actually redistribute it's coherent, but then it's just Pareto, not Kaldo-Hicks (potential Pareto)

@interfluidity Well yes it's Pareto because the redistribution created a new scenario.

the intermediate scenario is certainly not Pareto.

@interfluidity of course this always comes up when you advocate efficient taxes rather than progressive taxes because people are like, oh you're going to hurt the poor. No you moron you can just redistribute the money after the fact via UBI.

@cshentrup dude i've been writing in favor of UBI like forever. i'd prefer an income-tax financed UBI than say a VAT funded UBI, because i think compressing the income and wealth distribution is socially efficient. but almost UBI, however funded or not, is going to be great for the poor. importantly, we want it to be good for the middle class too.

@interfluidity but taxing income or any kind of human produced value is stupid because it creates dead weight loss. I mean, at the very least you want to exhaust all of your pigovian and land value taxes before you go there. some productivity taxes might still be utility efficient but it's a big gamble.

@cshentrup i think a pretty fundamental point of disagreement between us will likely be our views on the relationship between income and production. i think high levels of income (higher even than yours, this isn't personal) derive almost entirely from rents, and so it is efficient wrt to production to tax it. (rents hinder production by diverting resources to rent-seeking.)

@interfluidity this argument simply doesn't work because those taxes can't specifically target the rent seeking component of the wealth and rent-seeking is an incredibly tiny fraction of the wealth generated by rich people. they generate their wealth through capital allocation. just cannot be controversial. You can't tell me Warren Buffett got to be as rich as he is because he just got a lot more government graft.

@interfluidity never mind the avoidance issues.

@cshentrup most rents are not government graft. they derive from market power, the ability to prevent competition. Warren Buffet is famously open about how his wealth derives from businesses with moats.

@cshentrup under the hypothetical capitalism in neoliberal models, economic profits (ie those above market rates of return on entrepreneur and physical capital inputs) are transient rewards to innovation, for firms that jump ahead until competitors catch up. durable economic profits are rents in the sense they'd not prevail under perfect competition, though we might argue whether some barriers to competition (eg "network effects") are "legitimate".

@interfluidity but You can only know this in aggregate. You can't look at any specific company and calculate the percentage of their profits that came from a truly transformational technology, maybe like open AI, versus * anti- competitive * pricing power.

@interfluidity so you mean a rent in terms of having a monopoly in a country that doesn't sufficiently break up monopolies?

@cshentrup neoliberal models tell a really hopeful story about how markets work under the assumption of a close approximation of perfect competition. in the real world, there are lots of things that prevent such an approximation from holding. some of it is physical — Schumpeter famously pointed out that the corner store thrives due to the market power its proximity to some customers confer. 1/

@cshentrup "break 'em up" is not always and everywhere the right solution (though we should be doing a whole lot more of it!) but in general we face this challenge: if we want markets to be prosocial, they have to be in fact, not in theory, vigorously competitive, and we'll know that because extraordinary profits will be transient rewards, not permanent franchises. how do arrange that without killing other geese requires detailed attention by industry, i think, rather than broad strokes.

@interfluidity No you won't know because you can't disentangle the components of the profit that came from anti-competitive practices versus innovation. they are all mixed together.

@interfluidity I think you might be using an intermediate era definition of neoliberal because that doesn't match what the original or the modern day neoliberals believe at all.

https://twitter.com/ne0liberal/status/1665034853643853828?s=20

but regardless, you still can't accurately attribute the component of wealth derived from skilled allocation and value creation versus anti-competitive practices so I think it's mostly a moot point in practice.

@cshentrup we can't have perfect information, but i suspect our very different estimates will lead us to very different conclusions. (i gotta run!)

@interfluidity show me an example where you can even get in the ballpark. like where you could look at a company and say 60% of their profits were rents and 40% actual value creation so if we tax them it will only be "40% inefficient". and again even if you could do that, we already have plenty of untapped pigovian and land value taxes that are NEGATIVE dead weight loss and neutral dead weight loss respectively. I just don't even see a semblance of an argument here. help me out.

@cshentrup i'm not interest in taxing corps. that just encourages bad capstructure, until we also eliminate the tax deductibility of interest. i'm interest in taxing the very wealthy, and am entirely unconcerned that in cohorts among whom money represents score-keeping and zero-sum insurance, changing the baseline of competition by taxing them all equivalent will impair production. concentrated wealth imposes huge costs. taxing the very wealthy is a fiscal positive plus a social gain. win win!

@cshentrup (i do have some interest in taxing corp profits, if we can eliminate the deductibility of interest, because doing so encourages reinvesting in whatever creates an asset that firms can expense, including for example adopting a high-investment rather than high-turnover model of labor relations. but a guy who calls himself "neoliberal" is unlikely to be too enthusiastic about that argument.)

@cshentrup (and i'm interested in excess margins taxes, as a means of combatting market power. we want forms to maximize PQ by maximizing Q rather than P. again, i doubt i'm gonna persuade a guy whose moniker is "neoliberal", but this is directly a tax intended to support production rather than rents by reducing the relative value of exploiting pricing power vs expanding production.)

@interfluidity STOP the "persuade" nonsense. either you have valid argument or you don't. if you tax e.g. 40% efficient, that is WORSE than taxing land (0%) or pigovian (-%). this is grade school math. either you have an argument or you don't. what is your argument? please stop handwaving and SHOW DATA.

@interfluidity stop the ad hominem fallacies. either you have a valid argument or you don't. you don't want to "incentivize reinvestment". you want people to choose consumption vs investment *rationally*. minimize deadweight loss.

@cshentrup There are more things in heaven and earth, my dear Horatio, than can be drawn as Harberger triangles.

Money and investment are different things. Access to funds flows can sometimes rival rather than support investment. Perfectly rationally, from a shareholders perspective, but not from a social perspective. Those interests are different, and often misaligned.

@cshentrup the distinction between Kaldor-Hicks and the Pareto criterion is simply that the Pareto criterion requires the redistribution that would leave everyone better off, while Kaldor-Hicks only requires that such a redistribution would exist, regardless of whether it actually occurs.

@interfluidity we're in agreement I think. I will read your blog post later. your blog looks to be very much up my alley and radically beyond the mental capacity of 99.9% of the economic field that I've ever encountered including morons like Kenneth Arrow and Eric maskin.

@cshentrup it's nice to have a point of agreement! though i'll still prefer we not call people morons, some i might think highly of, some i might think less of, but regardless.

@interfluidity okay sure. I don't really have emotions or empathy so it's less of concern for me but if it makes you feel better...

@cshentrup it does! i appreciate your making an effort, even if it's only a matter of simulation.

@interfluidity I still don't know why you would call kaldor "incoherent". to me it just means that a policy can be good as long as we can augment it after the fact with redistribution.

@cshentrup i like Kaldor, and i think i've learned that in fact he was very concerned with actual rather than potential redistribution. but the Kaldor-Hicks criterion that has found its way into textbooks demands only that redistribution could be enacted, and licenses economists to declare a policy efficient whether or not politicians actually do. that, it turns out, is incoherent even on narrow economic grounds.

@interfluidity I mean yeah you're technically correct but in principle we can always tack on the redistribution later and it's only a matter of whether it's politically possible.

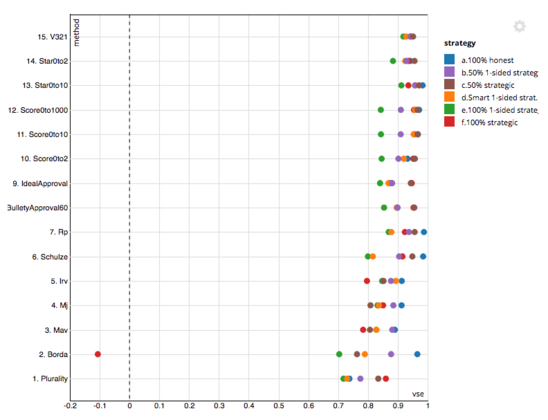

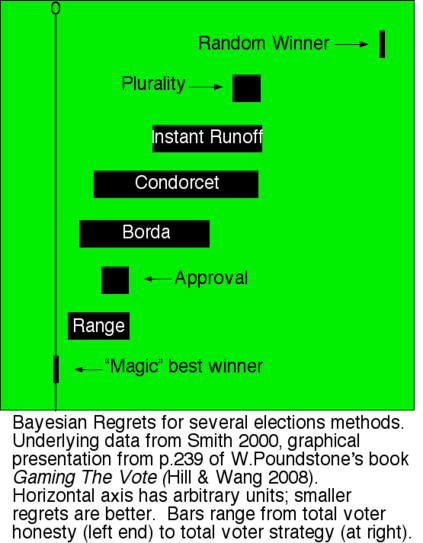

@interfluidity I'm surprised you're not more interested in alternative voting methods given they are far and away the biggest utility increaser of any kind of public policy we know of, and cost nothing.

@cshentrup i am! i think widespread adoption of approval voting is about the lowest-hanging-fruit reform available to us! I'm fond of your nonprofit. I've written about it some, mean to write much more. https://drafts.interfluidity.com/2023/04/24/two-kinds-of-representation/index.html https://drafts.interfluidity.com/2023/03/08/dilution-of-faction-requires-voting-system-reform/index.html https://drafts.interfluidity.com/2023/04/21/two-parties-make-us-stupid/index.html https://drafts.interfluidity.com/2023/04/28/urgency/index.html